As the data or operations leader for your insurance or insurtech company, you may be using artificial intelligence (AI) and machine learning (ML) to bring new solutions to market, fast. Perhaps you’re after better insurance outcomes through big data, analytics, and automation. Or maybe you’re digitizing and enriching insurance data to improve the underwriting function.

Great! If you achieve those excellent goals, you’ll give time back to underwriters and help grow the business.

But there are challenges. It could be that resources to scale your computer vision, AI/ML, or automation programs are in short supply. Maybe you need to cleanse model training data to improve the accuracy of platform outcomes. Perhaps you lack the data and metrics you need for fast underwriting decision-making. Or maybe you struggle with data health, quality, and integrity.

We never said it would be easy.

But is it worthwhile? Yes.

Consider, for example, how underwriters might respond if you said you’d be automating 50% of their work next year. How do you think they’d spend that extra time?

First, underwriters are generally skeptical of technology that could theoretically replace them.

“You still need a brain and instinct,” said one underwriter in the Insurance Insider’s market sentiment study.

Another underwriter in the same research voiced why underwriters might feel that way. “Sadly, most technology on the underwriting front removes the essential ‘judgment.’ Underwriters lose their granular and tactile feel on what makes one risk a better risk than another.”

Underwriters need not fear, though. Although McKinsey predicts that underwriting as we know it will cease to exist by 20301, the need for humans will live on. Underwriting is as much art as it is science, and pricing risk right requires the insight and experience of seasoned pros.

What could your underwriters do with 50% more free time?

Second, what would underwriters do with an extra 20+ hours per week? What would they do if you automated basic research, inputting, and processing tasks?

They’d have more time to focus on what you and the business care about:

- Managing relationships with books of business.

- Collaborating with cross-functional colleagues.

- Driving underwriting discipline and excellence.

- Improving negotiation skills.

- Becoming more skilled in the art of underwriting.

These things are possible—and coming soon—thanks to an explosion of third-party data sources and the rise of advanced automation technology and AI/ML. Like a stone skipping across a still mountain lake, such advances are sending ripples through the industry.

Yes, underwriters may be skeptical about advanced automation and technology. But you can start small and begin to transform the underwriting function today.

- One client streamlines quote generation by having our data analysts preprocess documents.

- Another focuses on scale and growth by offloading tedious data processing tasks.

- Yet another strengthens machine learning models with data our analysts extract and annotate.

- Several other clients use computer vision to identify risk characteristics and underinsured assets; we label the computer vision data.

But no matter the use case, one theme stands out: The need for accurate, high-quality data.

Today’s underwriting practice needs accurate, high-quality data

Whether you’re pricing risk, launching new products, or automating tedious tasks, you need quality data—lots of it. Without quality data, your initiatives will, at best, falter or, at worst, fail.

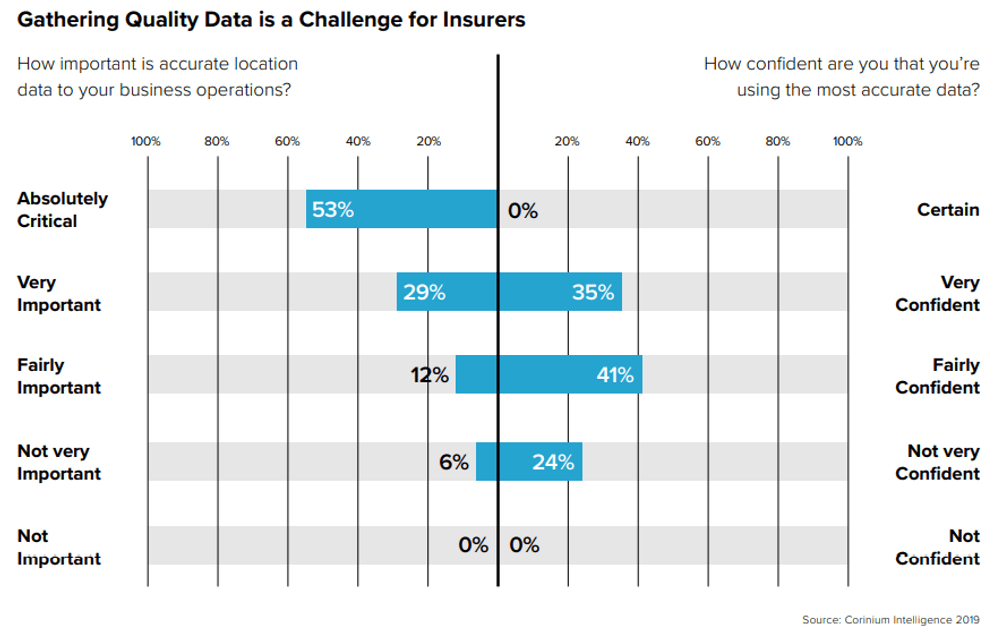

During their Risk Intelligence and Realising Risk roundtables, Precisely and Corinium Intelligence asked data leaders: "How confident are you that you're using the most accurate data?"

Though 53% ranked data accuracy as "absolutely critical," no data leaders—0%—felt “certain” they were using the most accurate data.

Source: Precisely and Corinium Intelligence, Future of Insurance Data 2020: How AI and Automation will Revolutionize the Industry Industry in 2020 and Beyond.

We’re fierce about the quality of your data

Because accurate data is so essential, CloudFactory is fierce about it. It’s also why we partner with each client to develop and pursue quality benchmarks. After working with hundreds of clients across data processing, natural language processing, and computer vision use cases, we developed a four-part quality management framework that encompasses quality documentation, quality assurance, quality control, and continuous improvement.

To explore the framework—and perhaps borrow from it for your data or underwriting practice—download our white paper: Outsourced Data Processing: A Quality Management Framework for the Finance Industry.

Take the next step

Curious about how CloudFactory’s managed workforce and approach to high-quality data can kick your advanced automation and AI/ML initiatives into high gear? Get in touch with our sales team for the insurance industry today.

–

1 Specifically, underwriting for most personal and small-business products across life, property, and casualty insurance.

Data Transcription NLP Finance and Insurance Automation & Back Office Support Data Entry